Workwear Industry Statistics – USA Market (2025 – 2035)

Executive Summary

Based on our proprietary market analysis by 2035, the United States workwear market’s projected revenue is expected to reach $5.2bn. We have also estimated to have a compound annual growth rate (CAGR) of 3.8% for the period of 2025 – 2035. The largest revenue-generating product segment in 2023 was workwear apparel, while the workwear footwear segment showed the highest growth acceleration within the same period.

What’s New in 2025?

Sustainability – Manufacturing workwear with sustainable materials to minimize environmental impact, meet regulations, and reduce potential health hazards. Manufacturers continue to innovate and develop PFAS-free workwear that will not compromise employee safety and performance.

ANSI/ISEA Updates – Every five years, the American National Standards Institute (ANSI) releases updates for the ANSI/ISEA 107 standard for high-visibility safety apparel. With the last update delivered in 2000, the standard is set to be brought up to date over the next couple of years.

NFPA 70E Adoption – Published by the National Fire Protection Association, NFPA 70E is a critical standard that is followed voluntarily by companies and enforced by OSHA. Its goal is to significantly reduce the risks of electrocution, electrical shock, arc flash, and arc blast, particularly in environments involving high-voltage equipment. There are four categories of protective wear for arc-rated PPE, depending on the risk (low to high) in the work environment.

Heat-Stress Programs – To protect employees in hot or humid conditions, companies develop heat stress training programs that include recognizing the risk factors, first-aid procedures, and the use of appropriate PPE. Protective clothing suited for high-temperature environments includes auxiliary body cooling ice vests, water-cooled garments, and reflective clothing. Workwear companies use advanced technologies to develop heat-regulating garments, maximizing employee comfort and safety.

Federal Infrastructure Tailwinds – Increased infrastructure investments result in a boost for the US workwear market. Building more infrastructure requires more workers, who, in turn, need more workwear, especially as the construction segment takes up the largest share of the workwear market. On the other hand, federal funding often goes together with strict requirements for safety equipment, ensuring that the workwear manufactured offers the highest levels of safety and performance.

U.S. Market Size & Growth

As we mentioned at the beginning, based on our estimates the US workwear market size in 2024 was US$3.45 billion. After extrapolating a moderate CAGR of 3.8% for the forecast period of 2025 – 2035, we estimate that the total market value of the workwear market would be approximately US$5.2 billion by 2035.

Segment Breakdown

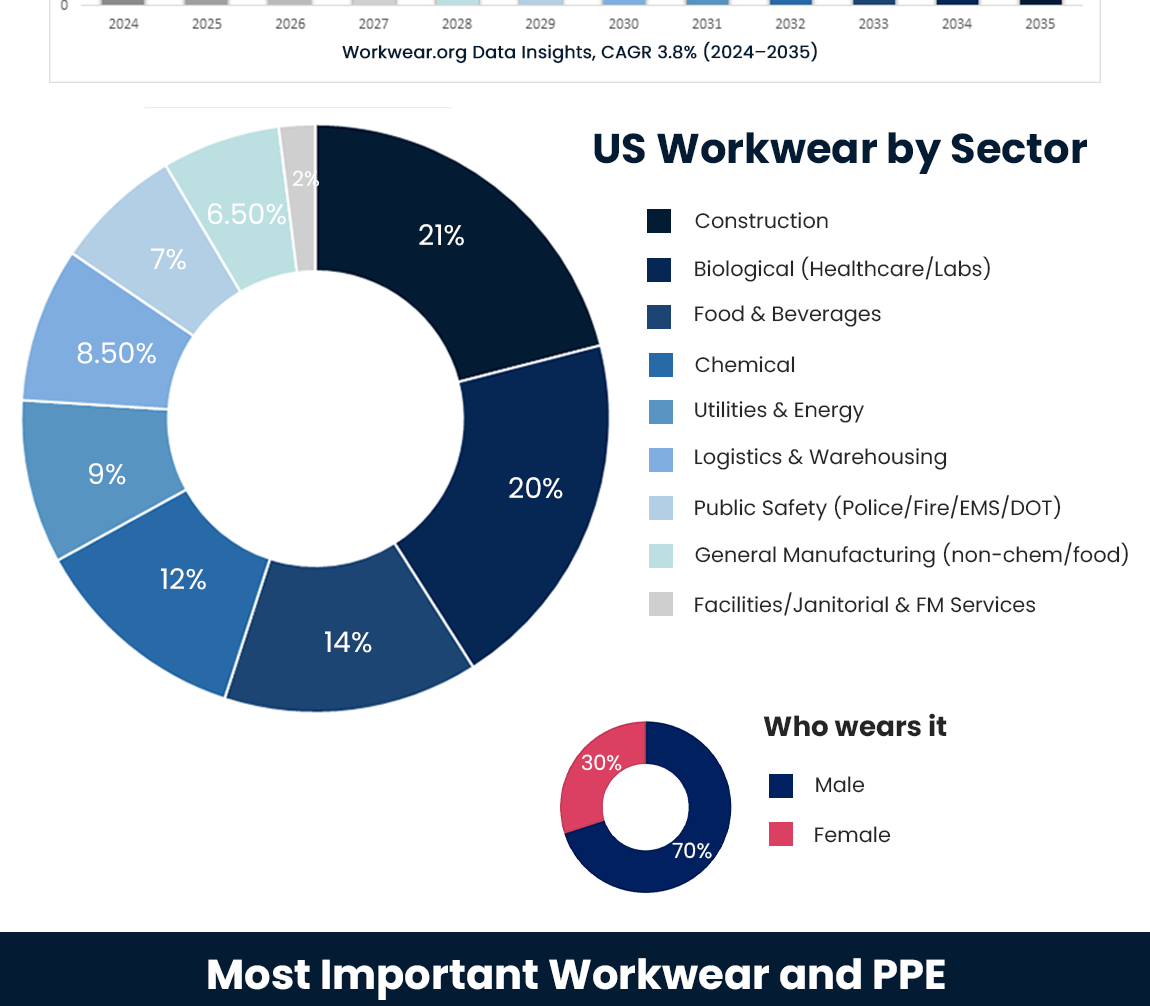

By sector the U.S. workwear market is primarily driven by construction (21%) and healthcare / biological sectors (20%). It is followed by food & beverages (14%), chemical (12%), and utilities & energy (9%). Other key users include logistics & warehousing (8.5%), public safety services such as police, fire, and EMS (7%), general manufacturing (6.5%), and facilities/janitorial services (2%). By Demography Workwear usage remains heavily male-dominated, with 70% of users being men and 30% women, reflecting the workforce distribution in industrial, construction, and utilities sectors. However, female participation has continued to grow in healthcare, logistics, and energy industries leading to increased demand for women-specific fit ranges.

Procurement Models

Managed Uniform Rental

A managed uniform program supplies, maintains, and launders workwear for businesses. Companies such as Cintas, UniFirst, and Aramark offer hassle-free services, including uniform style inception, branding specifications, weekly laundry, and garment maintenance. This option is cost-effective, convenient, offers customization and safety compliance, and fosters a professional, brand-positive image.

Uniform Distributors

Distributors such as Grainger and Fastenal offer a wide range of uniform and workwear for different industries and work conditions. They sell well-known workwear brands, making it easier to choose according to a company’s specific needs. Unlike managed uniform rental companies, workwear retailers don’t offer laundry and garment maintenance services.

Direct-to-Brand

Direct-to-brand workwear can be purchased directly either from the brand’s official website or in their physical store. Brands such as Carhartt, Red Kap, and 5.11 only sell workwear from their own product lines, unlike retailers that offer a wide array of brands for work apparel.

Custom Decorators

Custom decorators personalize workwear and uniforms with branding elements, including company names and logos. They offer plain uniforms and work apparel that can be embroidered or printed with the company’s brand, enhancing employees’ professional image and a sense of unity.

Total Cost of Ownership

The total cost of ownership over a workwear’s lifecycle is composed of the initial garment purchase price, lifespan cycles, laundering and cleaning expenses, maintenance and repair, loss rate, and disposal costs.

When Rental is Cheaper

- No Large Initial Investment – companies can avoid shelling out a large capital investment by renting instead of buying workwear.

- No Maintenance Cost – with rental companies handling the workwear cleaning and repairs, there are no additional costs for maintaining the garments.

- Compliance – workwear rental ensures that safety and legislative standards are met for work apparel.

- Minimized Environmental Impact – renting workwear prolongs the garment’s lifecycle and reduces waste.

When Purchase Wins

- Long-term Use – purchasing workwear allows companies to maximize the garment’s use for its lifecycle, eliminating the need to rent garments in the long run.

- Ideal for a Large Workforce – buying workwear in bulk is more cost-effective for companies with a large workforce, especially with a long-term, stable requirement for the apparel.

- Direct Supervision – it’s easier to manage the quality, customization, and maintenance of purchased workwear and uniforms compared to those that are rented.

Workwear vs PPE vs Uniforms vs Corporate Wear

Workwear – Any clothing that is worn to the workplace, either as required by the employer or personally chosen by the employee. Workwear can include safety features that overlap with personal protective equipment (PPE). On the other hand, they can also refer to basic uniforms or corporate wear that don’t protect against workplace hazards.

PPE – Personal Protective Equipment offers precise protection for specific body parts and against different hazards. These garments help minimize the risk of injuries in the workplace, with many categories being required by the OSHA to comply with ANSI standards, depending on the industry.

Uniforms – Worn by employees of an organization or company, uniforms are identical articles of clothing that can also be used to distinguish between professions or duties. For example, in a restaurant setting, kitchen staff can easily be identified by their uniforms that look significantly different from those of the foodservice staff. Uniforms can also feature company logos to establish identity, brand recognition, and a sense of unity.

Corporate Wear – Typically refers to formal clothing worn in a professional or corporate setting. Corporate attire examples include suits, tailored pants and skirts, and button-down shirts in conservative or plain colors. Employees can style corporate wear more personally (unless specified by the company), unlike uniforms that look identical.

Regulations & Standards that Move Budgets

OSHA Duty of Care – Under the General Duty of Care, OSHA requires employers to maintain workplaces that are safe from known hazards. This includes the provision of the appropriate PPEs and the implementation of a PPE program for employees – both of which need to be considered in budget planning.

High-Visibility Safety Apparel – PPEs for use in low-light conditions come in three performance classes (1, 2, and 3), which are dependent on the amount of background and reflective material involved. Class 1 offers low visibility for low-risk conditions with minimal traffic; Class 2 provides a medium level of visibility for roadside use and general work settings; and Class 3 delivers maximum visibility by having more reflective materials – ideal for high-traffic, low-visibility, or poorly lit environments.

NFPA 70E and NFPA 2112 – These standards are focused on fabrics and garments offering flame resistance and protection against arc flashes/arc blasts. Workwear ATPV (Arc Thermal Performance Value) measures the material’s ability to protect the wearer from the dangers of an electrical arc flash. PPEs have 4 categories corresponding to their minimum arc rating or protection levels. In high-risk settings, layering FR workwear significantly improves protection against arc flash and flash fire hazards.

Heat Stress Programs – Workers in hot or humid environments will benefit from heat stress training programs, aiming to enhance comfort and safety. These programs use the Wet Bulb Globe Temperature (WBGT) – an accurate indicator of heat stress to measure the true heat exposure on the body. Key factors of such programs that need to be considered in a company’s budget include the use of cooling PPE, shift scheduling with regular rest breaks, encouraging proper hydration, and acclimatization to high-temperature work conditions.

Chemical/PFAS Scrutiny – The push for PFAS-free workwear intensifies the scrutiny for garments that are free from hazardous chemicals. PFAS finishes are used as cost-efficient repellents for water and staining, so going for PFAS-free alternatives can involve a corresponding budget increase. There are currently no laws in the US compelling manufacturers to state the presence of PFAS in their fabric or garments. However, some states (such as California and New York) have started phasing out and regulating PFAS in clothing.

ESG/Scope 3 Implications for Textiles – With complicated workwear supply chains, it can be challenging to precisely track Scope 3 emissions, which represent the majority of a company’s greenhouse gas emissions. As a result, textile manufacturers can’t easily implement sustainable practices due to the challenges of gathering reliable data throughout the supply chain. Meanwhile, the quest for more sustainable workwear can require a relative budget increase for fabrics with lower GHG emissions.

Materials & Technology

Fabrics

- Cotton-rich – This fabric offers the best properties of cotton and polyester: comfort and durability. It’s less resistant to tearing and wrinkling, making it ideal for professional or industrial use. However, it easily absorbs and retains moisture and is prone to shrinking.

- Aramid – Aramid fibers are used for flame-resistant workwear. The high-performance fabric can be five times stronger than steel, creating extremely durable PPE offering superior protection with long-term use. Aramid’s dense structure doesn’t have much breathability, but the maximum protection it delivers will more than make up for the minor discomfort – especially in hazardous work environments.

- Modacrylic – Workwear made with modacrylic fibers comes with strong flame resistance and durability. The soft fabric is comfortable to use, but it’s more expensive than other synthetic materials and is prone to pilling.

- Durability Metrics – The Martindale abrasion test determines a workwear’s durability and tendency to pill with normal use. Tests for tear strength include the Elmendorf Tear Test (ASTM D1424) and the Trapezoid Tear Test (ASTM D4533), while colorfastness is established using AATCC 61 and AATCC 8 standards.

PFAS-free DWR treatments make workwear water-repellent without the harmful “forever chemicals”. Meanwhile, recycled polyester offers all the benefits of virgin polyester (including stain resistance and durability), but it consumes a lot less energy to manufacture.

The use of organic cotton is another push towards sustainability without compromising comfort and performance in workwear. Certifications such as bluesign (for minimal environmental impact and chemical management) and OEKO-TEX (testing textiles for harmful substances) ensure that workwear products are safe and environmentally friendly.

Smart wearables are now integrated into workwear for maximum productivity, safety, and comfort. These enhancements include smart fabrics that respond to the wearer’s body heat and moisture, BLE tags for laundering cycles, and sensors for proximity and fall detection that can determine if a worker is down and needs urgent help.

Trends to Watch (2025–2035)

- PFAS-free water repellent workwear is expected to go mainstream as more brands offer water-repellent products using silicone-, bio-, or water-based finishes instead of traditional DWR.

- Made-in-USA niches will expand via government contracts, mainly with legislation such as the National Defense Authorization Act (NDAA), the Berry Amendment, and the Defense Production Act (DPA). These direct the use of American-made components and textiles for military gear and/or uniforms.

- The need for workwear offered in women’s fit and inclusive sizing will be considered a necessity for safety purposes, not just for comfort.

- Customization at scale featuring on-demand embroidery and the use of DTF (Direct-to-Film) printing for workwear, with 2-week SLAs for maximum efficiency and timeliness.

- A spike in the demand for heat-adaptive garments and cooling accessories to address the need for comfort and protection in extreme temperatures.

- Vendor consolidation and private label growth among distributors to cut costs, boost supplier relationships, and enhance efficiency.

- Companies aiming to purchase more sustainable workwear and gear as part of initiatives to minimize environmental impact.

Competitive Landscape (U.S.)

- Workwear Manufacturers/Brands – Carhartt, Workwear Outfitters (Red Kap, Bulwark FR), 5.11, Ariat Work, Dickies, Under Armour Work, Lakeland, National Safety Apparel, Honeywell (apparel), 3M

- Rental & Services – Cintas, UniFirst, Aramark

- Distributors – Grainger, Fastenal, MSC, Uline

- E-commerce/Specialists – Shopify, Amazon

FAQ

- Rental vs purchase—what’s cheaper for 200 field techs?

- Renting workwear for 200 field techs is cheaper because the company will not need a large initial investment. This option is better if the techs use the workwear for short or infrequent periods, as rentals also offer flexibility in terms of the quantity needed.

- Is PFAS-free hi-vis as durable?

- Yes, PFAS-free hi-vis workwear is just as durable. In fact, workwear whose main characteristic is high visibility doesn’t automatically need water repellency, which is why DWR finishes (traditionally with PFAS) are used in the first place. Durable hi-vis clothing can be manufactured with PFAS-free components without compromising performance.

- Which standard applies to night road crews?

- ANSI/ISEA 107-2020 is the standard that applies to night road crews. It details performance specifications of high-vis safety apparel (including safety vests, shirts, rainwear, and outerwear) that help the user to become more visible or conspicuous under any light conditions.

- How many laundering cycles should FR last?

- FR workwear can last anywhere from 50 to 100 (or even more) laundering cycles, depending on various factors. Well-made garments with high-quality materials can withstand more wash cycles, and following proper washing instructions contributes to the workwear’s longevity, too.

- Do women’s cuts affect PPE compliance?

- Yes, women’s cuts and sizing can affect PPE compliance. Ill-fitting workwear can make it more difficult for female workers to move comfortably and safely, resulting in higher injury risks and reduced PPE compliance.

678+

Products Reviewed

24+ Years

Combined Experience

500+ Hrs

Field Testing